Table of Content

You will need to fill out all of the appropriate tax forms in order to claim deductions. This may include business income tax forms, as well as any state-specific tax forms. The cost of business insurance premiums can be deducted as a business expense. Note that some types of insurance may only be deductible if they are related directly to your business operations. Any rental payments for business property such as an office, warehouse, or equipment can be deducted.

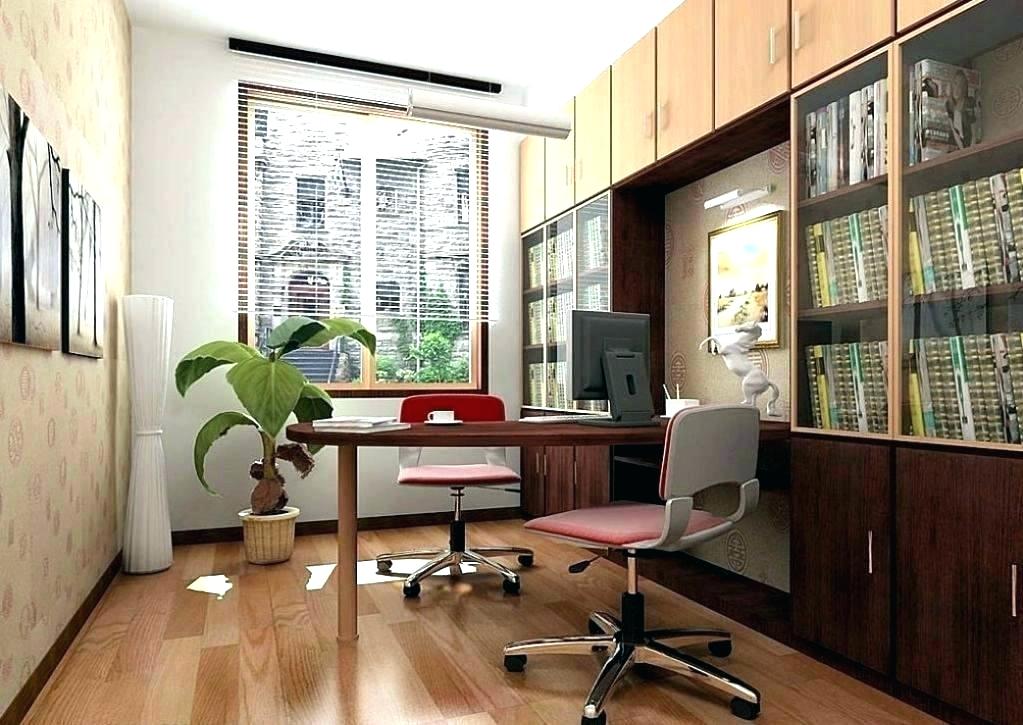

Remember, the IRS says you can take a home-office deduction as long as the home office is your primary place of business, and the space is dedicated only to work. But if you work for an employer, you can’t claim it, and “that’s anyone who gets a W-2, basically,” Corrente said. For example, if you started using your home in July 2019, you can take six months of indirect expenses and all direct expenses incurred from July – Dec 2019. But if you claimed a home office deduction for business use of your home, things are a little trickier. It’s a cool trick that allows you to deduct a portion of the cost of your property each year even though real estate usually increases in value. Next, gather all expenses for your home and group them by direct and indirect expenses.

Business Vehicle Expenses

The amount you can deduct related to casualty losses are calculated based on the adjusted value of your home or its decrease in value. Security systems that guard the windows and doors of your house can be deducted. You deduct just the expense to secure the business part of your home.

The downside of that method for homeowners, Corrente said, is that you will have to recapture any depreciation you wrote-off if you sell your home and pay taxes on a gain from the sale. Regardless of which method you ultimately choose, you should crunch the numbers on both options before deciding. Money Done Right is a website devoted to helping everyday people make, save, and grow money. While our team is comprised of personal finance pros with various areas of expertise, nothing can replace professional financial, tax, or legal advice. You don’t have to calculate depreciation to claim the home office deduction if you use the simplified method. Use Form 8829 to calculate your home office deduction using actual expenses.

Can Anyone Who Worked From Home Claim The Home Office Tax Deduction?

For example, assume you use an extra bedroom as your home office. The bedroom is 200 square feet and your home is 2,000 square feet. You can claim the home office deduction if you use a space that is detached from your home.

Exclusively and regularly as a place where patients, clients, or customers are met in the normal course of a trade or business. Our mission is to protect the rights of individuals and businesses to get the best possible tax resolution with the IRS. There are some instances where you do not need to meet the exclusive use requirement.

The home must be the principal’s place of business.

Finally, consider contributing to a retirement plan such as an IRA, 401, or SEP-IRA. These contributions can be deducted from your taxable income, reducing your overall tax liability. Beginning with 2013 tax returns, the IRS began offering a simplified option for claiming the deduction. This new method uses a prescribed rate multiplied by the allowable square footage used in the home.

The greenhouse qualifies for the home office deduction even though the floral shop is your principal place of business. The costs incurred to maintain a home office are deductible on your tax return. The regular method computes the exact percentage of your home used for business and applies that percentage to your home expenses to quantify your home office deduction. You can use the simplified approach, which is taking the square footage of your home office and multiplying it by $5. This means that the maximum you can deduct under the simple method is $1,500.00 if you have a 300 square foot home office.

Money Done Right and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Logan is a practicing CPA and founder of Choice Tax Relief and Money Done Right. After spending nearly a decade in the corporate world helping big businesses save money, he launched his blog with the goal of helping everyday Americans earn, save, and invest more money. You’ll deduct this on line 9 of Schedule C. It’s not part of the home office deduction.

If your business earns income in a foreign country, then you may be able to take advantage of the foreign-earned income exclusion. This can help reduce the amount of taxable income that you owe on your business earnings. While employees may feel like they're missing out, the home-office deduction isn't generally leading to outsized savings for those who take it. Because of this calculation, people with larger homes may not get as much using this method, said Markowitz. You can switch methods year to year and should try to calculate both to see which will yield a larger deduction.

Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Seek advice on your specific circumstances from an IG Wealth Management Consultant. If you own the car, you can also deduct a percentage of its cost as depreciation.

O find out what your home office deduction is, you’ll multiply your $30,000 of home expenses by the 33% of your home that’s used for your business. Then it applies that percentage to all of your home expenses to find the direct expenses that are applicable to your business. If this is anything like you, then you should use the regular method to calculate your home office deduction. With a rising number of Americans working from home, there are other ways to qualify for the home deduction. However, the process does become a little more complicated for regular employees.

You may be able to exclude the gain if you lived in the business part of your home for the last two of the previous five years. This copyrighted material may not be republished without express permission. The information presented here is for general educational purposes only. If your main workstation is not at home, but you have a dedicated place in your house where you receive clients, patients, or customers.

No comments:

Post a Comment