Table of Content

The simplified method can make it easier for you to claim the deduction but might not provide you with the biggest deduction. TurboTax makes it easy to determine if you qualify and how much you can write off by asking you simple questions about your unique tax situation. TurboTax has you covered whether your tax situation is simple or complex. We’ll help you find every deduction you qualify for and get you every dollar you deserve. The biggest roadblock to qualifying for these deductions is that you must use a portion of your home exclusively and regularly for your business. Multiply the total cost of electric bills in the tax year by the percentage of your home used for business.

Articles provided in connection with this blog are general in nature, provided for informational purposes only, and are not a substitute for individualized professional advice. We make no representation that we will improve or attempt to improve your credit record, history, or rating through the use of the resources provided through OppU or the OppU Blog. If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. With TurboTax Live Full Service Self-Employed, work with a tax expert who understands independent contractors and freelancers. Your tax expert will do your taxes for you and search 500 deductions and credits so you don’t miss a thing.

Foreign Earned Income Exclusion

But here’s the kicker – you can only do this for up to 300 square feet. So those are the individuals who qualify, and if that’s you, you’re probably wondering what you can deduct. In today’s post, we’re going to help you do this with the home office deduction. But don’t worry, you’re not alone… More than 2 million people overpay the IRS every year.

The cost of repairs and the labor required to do them is a tax deduction, according to the IRS. Multiply the total amount of interest paid by the percentage of your home used for business. Mortgage interest and rent payments can be deducted, but only the portion that applies to your home office. Finally, unrelated expenses apply to areas of the home not used for the trade or business purposes and these cannot be deducted. "Home expenses must be segregated into direct, indirect, or unrelated," Burnette explains.

How small business owners can deduct their home office from their taxes

In general, a taxpayer may not deduct expenses for the parts of their home not used for business; for example, expenses for lawn care or painting a room not used for business. For those who meet all the space usage requirements outlined above, a variety of expenses are eligible to be written off on your annual tax return. Are there other details about tax deductions on business use of home you wish to share? To write off taxes for home offices, simply take note of the guide provided in this discussion.

The gradual depreciation in the value of your assets, such as vehicles, computers, machinery and even furniture can be used as small business tax deductions. Standard deductions are a set amount that taxpayers can deduct from their taxable income to reduce overall tax liability. This deduction is available to those who do not itemize their deductions on their tax return. There are certain expenses you can’t deduct in 2022 but are scheduled to return by the 2026 tax year.

What are the Requirements to Take the Home Office Deduction on Your Tax Return?

Effortlessly manage your online reputation, get more reviews, engage more prospects, improve customer experience and grow sales with Birdeye's all-in-one, award winning platform. Don’t forget you can use the latest accounting software for small business to find out what your tax liabilities are for the year. As a small business, you can deduct 50 percent of food and drink purchases that qualify. Good record-keeping is mandatory for whatever you’re doing relating to taxes,” Anderson said. Get a statement from your employer that you’re working from home out the employer’s convenience if you are a home-based worker. Money Done Right has partnered with CardRatings for our coverage of credit card products.

They are different from tax credits, which are a dollar-for-dollar reduction in taxes owed. This guide offers everything you need to know about taking advantage of the best small business tax deductions during the 2022 tax year. If you’re a small business owner, you know what an arduous undertaking it is to manage your taxes. In order for an employee to get reimbursed for their home office expenses, she said, the company would have to have an accountable reimbursement plan and pay employees back directly. But employees are not able to claim those expenses on their tax return. If you’re self-employed and your business will be claiming a profit for the financial year, you are eligible to deduct 100% of your insurance.

The regular method

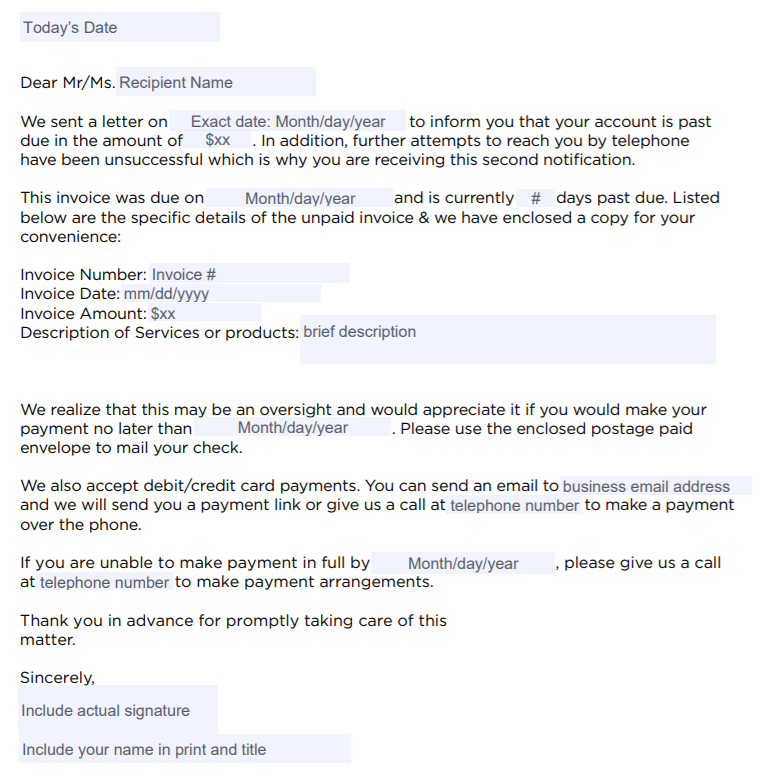

Allen adds this allows the employer the ability to deduct the reimbursement as business expenses, which may further incentivize them to recompense you. Where you enter your regular home office deduction expenses on your Form 8829. There are two options available to claim the home office deduction—the simplified option and the regular method. To qualify for the deduction you must be a partner or self-employed, such as a rideshare driver. This includes anyone who receives a W-2 or a regular paycheck from their employer.

If you dedicate part of your home for business use, you can take ahome office deduction,per the IRS. Some office furniture such as desks and filing cabinets can also be deductible. You can still claim your home office deduction even if your outside accountant completes your bookkeeping at their location. Since the adjusted basis is less than the fair market value, you’ll use the adjusted basis to calculate depreciation.

You must use the office regularly and exclusively for your business. Special rules apply if you qualify for home office deductions under the day care exception to the exclusive-use test. In the simplified version, you can take $5 per square foot of your home office up to 300 square feet, giving the method a $1,500 cap. For the tax years 2018 through 2025 small businesses with home offices will not be able to deduct HELOCs. The only exception is if your loan is for building, buying or greatly improving your house.

The regular method takes the exact square footage of your home office and divides it by the total square footage of your home to find the percentage of your home that is used for business. Water, electric, internet, and heat are just a few line items that may qualify for some sort of home office tax deduction. Our Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they know it's 100% correct and you are getting your best outcome possible.

No comments:

Post a Comment